Leadership Team

Combining institutional finance expertise with proven entrepreneurial success across multiple exits and $11B+ in transaction experience.

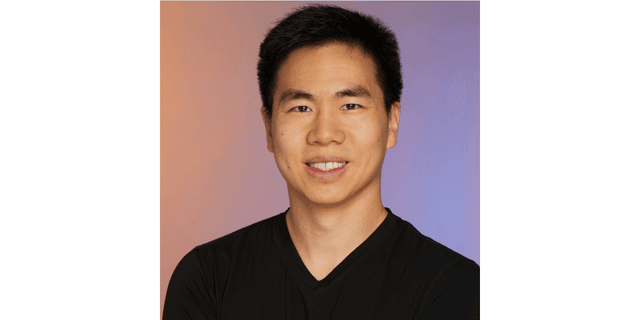

Sean Smith

Managing Partner

Education

MBA, Finance & Strategy

BS, Business Administration

Professional Background

Search Fund Ventures - Managing Partner

Sean leverages his comprehensive background in institutional finance and entrepreneurship to lead Search Fund Ventures' investment activities.

Tangerine House - Entrepreneur & Exit

Sean co-founded and operated Tangerine House, a direct-to-consumer wellness brand, providing first-hand entrepreneurial experience. He successfully scaled the business and executed a strategic exit.

- Built operations from startup to profitable exit

- Developed e-commerce capabilities and digital marketing expertise

- Successfully navigated exit process as seller

Applico Capital - M&A Advisory

Following his investment banking career, Sean joined Applico Capital as a Principal focused on sell-side M&A advisory for technology-enabled service businesses. This role provided critical insight into the entrepreneur's perspective.

- Advised business owners on exit strategies and value optimization

- Developed relationships with strategic acquirers and financial sponsors

- Gained deep understanding of seller motivations and deal structures

CIBC World Markets - Investment Banking

Sean spent seven years in CIBC's Investment Banking division, where he advised clients on M&A transactions, capital raises, and strategic initiatives totaling over $11 billion in transaction value. His experience spanned multiple sectors including technology, healthcare, and industrial services.

- Led execution on 25+ M&A transactions ranging from $50M to $2B

- Specialized in mid-market B2B service businesses

- Expert in financial modeling, valuation analysis, and market assessment

- Built relationships with private equity firms, strategic buyers, and institutional investors

Core Expertise

- • M&A Execution & Valuation

- • Financial Analysis & Modeling

- • Due Diligence & Risk Assessment

- • Capital Markets & Fundraising

- • Operational Improvement

- • Strategic Planning

Nick Bryant

Founding Partner & Anchor Investor

Education

MS, Computer Science

BS, Aerospace Engineering

Professional Background

Search Fund Ventures - Founding Partner

As Founding Partner and anchor investor, Nick brings his technology expertise and entrepreneurial experience to Search Fund Ventures' investment strategy.

Interesting Inventions Inc. - Founder & CEO

Nick founded and leads Interesting Inventions Inc., a technology development company that creates AI and automation solutions for traditional businesses.

- Developed proprietary AI automation platforms

- Helped 50+ traditional businesses implement technology solutions

- Created repeatable playbooks for technology transformation

- Generated proven ROI metrics for automation initiatives

Arcanium.vc - Venture Capital & Angel Investing

Nick founded Arcanium.vc, an early-stage venture capital fund focused on AI and automation startups.

- Invested in 15+ AI and automation startups

- Developed systematic approach to technology due diligence

- Provided strategic guidance to portfolio companies

- Built extensive network in technology and venture capital

SharpSpring - Early Engineer & Growth Driver

As an early engineer at SharpSpring (NASDAQ: SHSP), Nick played a crucial role in building the marketing automation platform that directly competed with HubSpot.

- Built core platform features supporting thousands of customers

- Developed scalable software architecture for rapid growth

- Gained deep expertise in SaaS metrics and business models

- Experienced IPO process and public company operations

NASA Ames Research Center - Intelligent Robotics Group

Nick began his career at NASA Ames in the Intelligent Robotics Group, working on cutting-edge AI and automation projects. This foundational experience provided deep technical expertise in artificial intelligence and machine learning.

- Developed AI algorithms for autonomous navigation systems

- Worked on machine learning applications for space exploration

- Published research on intelligent autonomous systems

- Gained expertise in robotics, AI, and automation technologies

Core Expertise

- • Artificial Intelligence & Machine Learning

- • Business Process Automation

- • SaaS & Technology Business Models

- • Product Development & Scaling

- • Technology Due Diligence

- • Digital Transformation Strategy

SFV Proprietaries

Our proprietary deal sourcing and acquisition team, focused on direct acquisitions of lower-market B2B businesses.

About

As a business operator and former investment banker, Matt brings SMB strategy & operations expertise and dealmaking experience to the deals we evaluate alongside our investor network.

Matt started his career in investment banking at Citi (M&A Group) and Credit Suisse (Financial Sponsors Group) in New York, where he worked on leveraged buyouts and strategic transactions for financial sponsors.

He transitioned to the operating side at CIS Group, spending nine years rising from Director of Corporate Development to Chief Operating Officer and ultimately Chief Executive Officer. He also founded West Fourth Sartoria and currently serves as CEO of GLOOKAST, a media technology company.

At SFV, Matt leads proprietary deal sourcing and acquisition execution — identifying targets, building relationships with business owners considering a sale, managing the deal pipeline, and coordinating diligence through close. His focus: recession-resistant service businesses, light manufacturing, and B2B companies with $500K–$5M EBITDA.

Matt holds a B.S. in Business, Finance and Economics from NYU Stern School of Business (Cum Laude, University Honors Scholar).

For business owners exploring a confidential conversation about selling their business, Matt can be reached at matt.silva@searchfundventures.co or through our Sell Your Business page.

Advisors

Industry leaders who provide strategic guidance across finance, technology, operations, and growth.

Nelson Chu

Advisor

Founder of vn.ai and former founder of Percent.com, a leading private credit platform. Nelson brings deep expertise in strategy, finance, fundraising, marketing, and operations from building and scaling successful startups in AI and fintech.

LinkedInPartner with Proven Leaders

Our leadership team's unique combination of institutional finance expertise and entrepreneurial success provides the foundation for superior investment performance.